Composer: Social Trading great idea with poor pricing model

During the last few years there has been a lot of innovation happening in Fintech and I enjoy experimenting with services in the space for “fun and profit”. I usually start with a small amount, and may increase it by getting more confidence in a service – while of course someone may be running “long con” (Bernie Madoff was doing it for more than 17 years) at least you can see poor technology implementation, customer support or general execution relatively quickly.

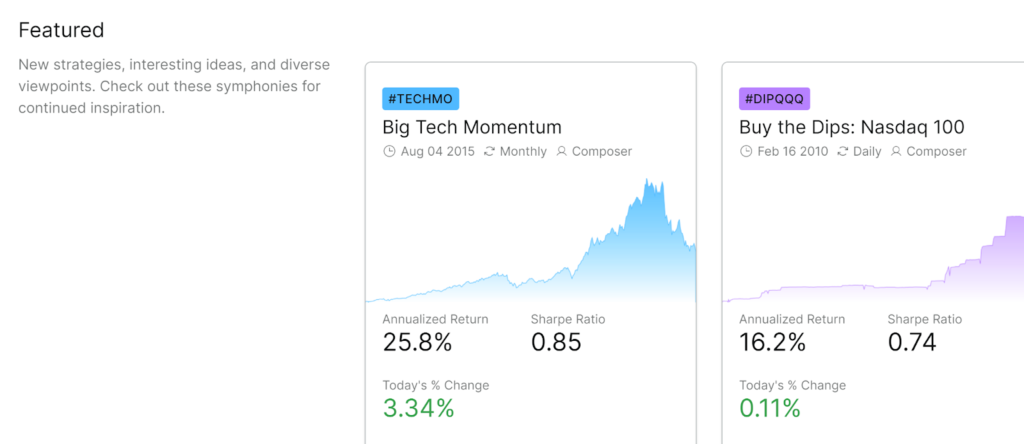

Composer.Trade, founded in 2020 is what I would Call “social trading” application – you can develop stock trading strategy “Symphony” using a simple but powerful “no code” framework or invest in existing Symphonies created by Composer Team or other users.

It reminds me (now defunct) Motif Investing which allowed to invest in community created stock lists, Composer though has focus on trading rather than long term investing.

Composer focuses a lot on “Backtesting” – for any Symphony you can check how it would perform in the past to get some idea on how it might perform in the future.

This is perhaps the most helpful feature Composer offers in the Free Tier in their Freemium model.

Unfortunately what kills this trading nirvana is pricing model:

There is a fixed $288 a year fee to “become a member” with only one month trial, which in my book is an impractically short time for investing/trading products.

I think Composer is also being disingenuous with their “minimum recommended investment” amount, which they state is $2500 – with this amount you will be spending 11.5% of your capital on yearly fees, drastically reducing change of positive investment returns.

In my book you should strive for no more than 1% of yearly fees for such automated service, which means this pricing model becomes reasonable at $30.000 invested which is probably more than RobinHood investment crowd will be ready to play with.

Though if Composer instead strives to target users ready to start with much higher capital commitment, it makes sense.

In my opinion, for a service like Composer which seems to be looking to leverage Social Aspect, reducing barriers to entry would be important as it is usually folks with little money who have a lot of time on their hands to go around and promote your service’s awesomeness.

I would imagine pricing models where you limit the amount of money you can have on the platform before you have to become a paid subscriber or might be having a limited set of trading strategies available for free (perhaps those which do not generate a lot of trades, if these come with significant costs).

It is worth noting though per Crunchbase Composer is rather early stage, having raised a rather small amount of Seed Capital (compared to many others in Fintech space) and it is possible they are using their pricing plan as intentional gating to control the growth of number of users on the platform. As you may learn from Robin Hood Story fast growth may bring its own challenges.

In the nutshell I find it quite an interesting project and I will be following how the service develops!

Nice Article,

Social trading is a great idea that has the potential to democratize investing and make it more accessible to everyone. However, Composer’s current pricing model could be a barrier to entry for some potential users.

I had latest information about Social Trade Platform.

Read more – https://www.theinsightpartners.com/reports/social-trading-platform-market