Dividend Model for Open Source Based Companies

Typical Paths for the company built around Open Source are Bootstrapping or Raising Venture Capital, or at least this is the binary choice many founders see. Bootstrapping is long and hard and if the Founder does not have significant personal capital may not work for many business models. The Venture Capital path though often goes in conflict with true Open Source Values and also does not work for every business model. These should not be the only options though!

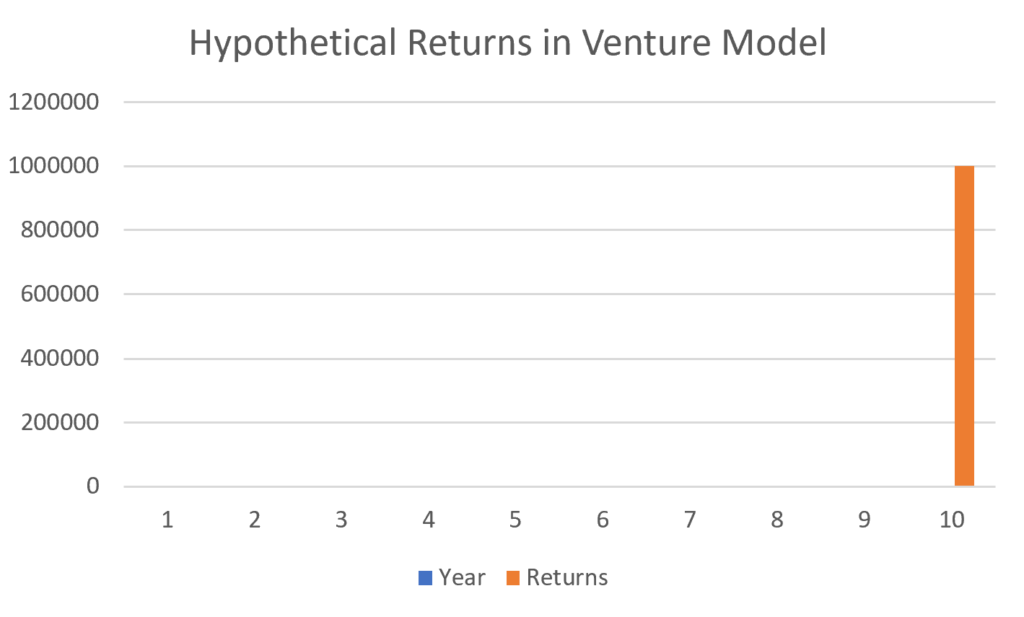

The Venture Capital model is a high-risk, high-reward one. Even though VCs are selective in their deals they still assume only 1/10 of companies they invest in will be really successful. This means they are looking for companies that pursue exit for hundreds of millions (better billions), and plan to get there within a few years providing 50x + returns for early-stage investors. This is not a path every Open Source Founder wants to go, and not every Open Source has the potential to go.

For example, there are a lot of Service Based opportunities in Open Source space or opportunities for niche SaaS (OpenSaaS) with robust but relatively small markets that, while they may provide founders with small teams with good jobs and good living, may not have “Billion Dollar” exit potential. Neil Thanedar describes this problem well in his article.

There are other paths though. In fact, try Google-ing for “alternative to vc” and you will find a lot of more (and less) creative and feasible options. Among other Options Tinyseed.com particularly stand out, while they do not focus on Open Source, they do offer flexible investment options similar to the idea below.

Guess what, while Tech Scene may make you think raising (traditional) Venture Capital is the most common path, it is not – outside of Tech Bubble very small portion (less than 1%) who attract capital do it based on VC Principles. Think about Restaurants, Dog Grooming Franchise Locations, Dental Practices, Gyms, or Real Estate Deals.

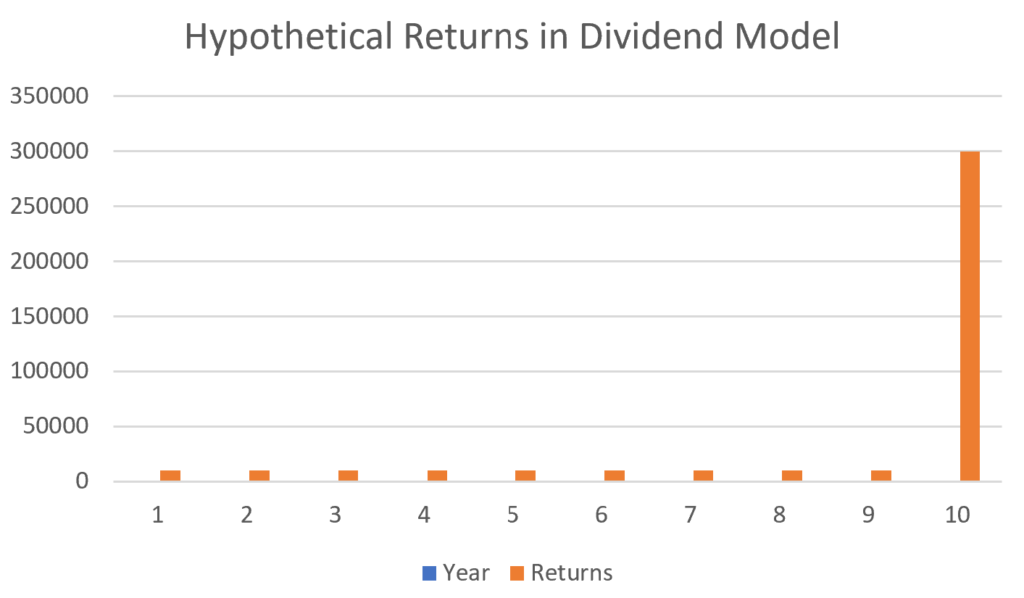

Many such businesses attract private (and possibly institutional) capital, but they rely on different return models for investors. Rather than the small likelihood of a very large payout after a certain number of years, they typically rely on securing investor returns year after year through dividend distributions. Because they provide income they can be held forever, which Warren Buffett Says is not a bad thing, though liquidity options may still be available, though likely with less multiple of your investment. For a number of investors getting supplementary income in retirement is more valuable than a potential big payout many years in the future.

One way such investment can be structured is Preferred Shares (a special class of shares) which pay the higher guaranteed distribution (say 15% a year and what is paid to common shareholders) as well as 1x preference right to make sure the company is sold such investors are paid first.

What are the conditions required for this approach to make sense:

– Profitable Growth business model, Business plan should look for profits to support distributions in the short-medium term, rather than prioritize hypergrowth to get to the next funding round.

– Stage of the company when debt through SMB administration or solutions lighter capital is not available.

– Reasonably low risk of loss of capital (company going under).

As such I would not invest in such deal(s) info extremely early-stage businesses that are not in sight of their revenue or have yet to figure out how to have profitable unit economics.

When it comes to Open Source Founders though I see this scenario as quite typical – a technical founder has built an amazing project and has companies coming to them to get help – looking for consulting, support, easy to use SaaS option. Founders often will be able to sign some deals with early adopters even to the point of making a living from the project, but they often lack the resources and skill to take it to the next level. Even if you’re looking for a services business model building out a proper website and marketing systems and collateral, a proper sales process can make wonders.

Scaling SaaS is another fantastic potential – even with great growth numbers and ROI from Sales and Marketing investments, SaaS may require quite a bit of cash to grow, especially early on.

There are many other cases when the likelihood of success is high and the probability of loss of capital is low that could fit this model.

What do you think? Would something like this be attractive to you as an Open Source Founder? As Investor?